20 Economic Policies That Had Unexpected (and Disastrous) Consequences

When policymakers implement economic plans, they typically envision positive outcomes – growth, stability, and prosperity. But history is littered with well-intentioned economic initiatives that backfired spectacularly, often creating the exact opposite effect of what was intended.

These missteps have shaped nations, toppled governments, and in some cases, altered the course of world history. Here is a list of 20 economic policies that produced unexpected and disastrous consequences, serving as cautionary tales about the complexity of economic systems and the law of unintended consequences.

Smoot-Hawley Tariff Act

The 1930 legislation raised tariffs on over 20,000 imported goods to protect American businesses during the Great Depression. Instead of helping – it triggered retaliatory tariffs from trading partners, causing U.S. exports to plummet by nearly 67% and deepening the economic crisis.

What began as an attempt to protect American jobs effectively collapsed global trade, exacerbating unemployment and turning a recession into the worst depression in modern history.

China’s Four Pests Campaign

As part of the Great Leap Forward in 1958, Mao Zedong ordered the elimination of rats, flies, mosquitoes, and sparrows, which were eating grain seeds. With sparrows nearly eradicated, the insect population exploded without their natural predator, devastating crops across China.

This ecological disruption, combined with other agricultural policy failures, contributed to the Great Chinese Famine that killed an estimated 15-45 million people, demonstrating how environmental and economic policies are inextricably linked.

Like Go2Tutors’s content? Follow us on MSN.

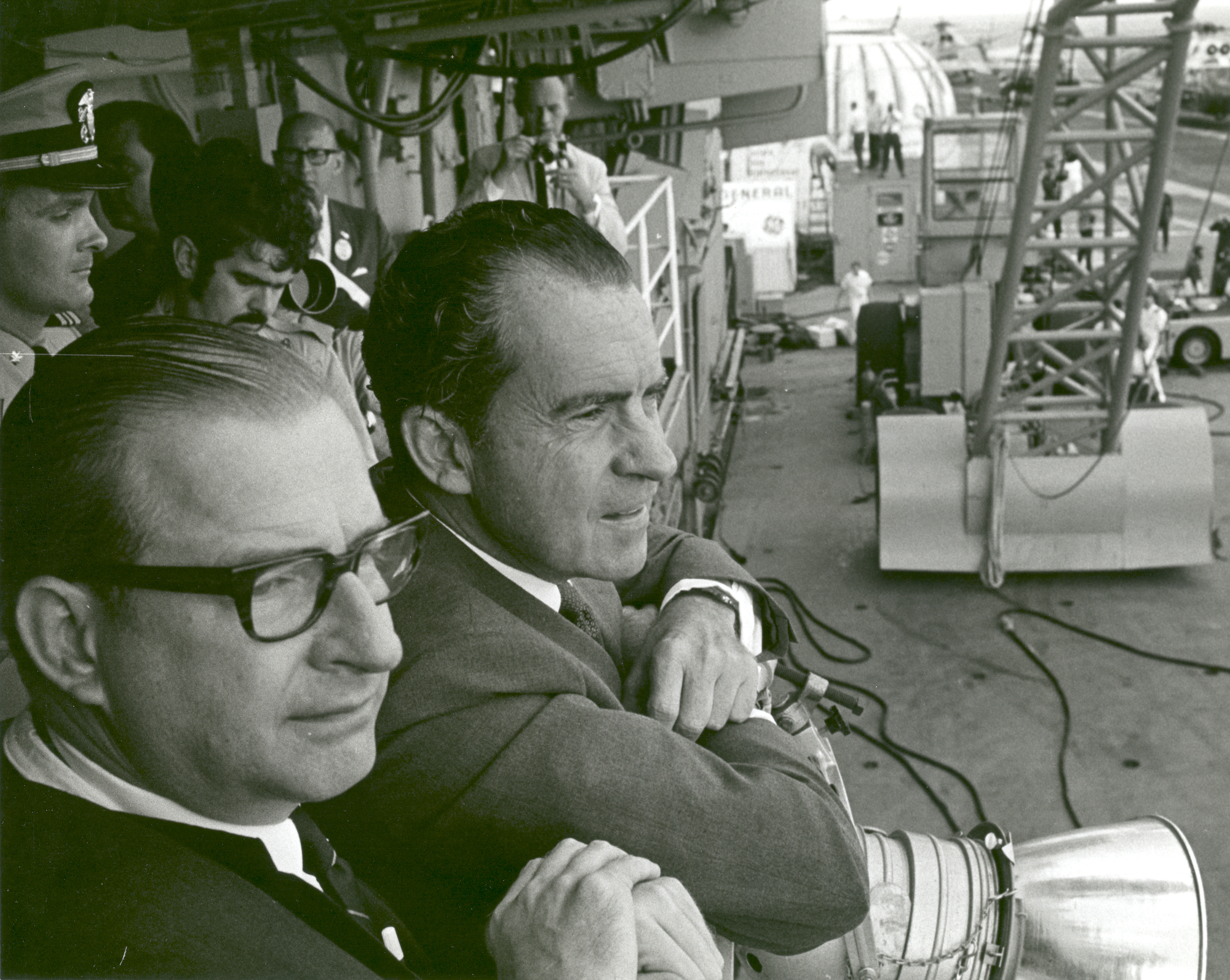

Nixon’s Price Controls

In 1971, President Nixon imposed a 90-day freeze on wages and prices to combat inflation, later extending controls through 1973. Rather than stabilizing prices – the policy created widespread shortages, black markets, and reduced production.

When price controls were finally lifted, inflation surged even higher than before. The artificial suppression of market mechanisms only delayed and amplified the economic problems they were meant to solve, leading to gas lines and economic distortions that defined the 1970s economy.

The British Corn Laws

These protectionist trade barriers, maintained from 1815 to 1846, restricted grain imports to protect British landowners. The resulting high food prices led to widespread hunger among the working class while industrial growth stagnated.

The laws created such economic distortion that they sparked the Anti-Corn Law League, one of history’s first successful single-issue political campaigns. Their eventual repeal marked Britain’s shift toward free trade but came too late for many who suffered unnecessarily from artificially inflated food costs.

Thailand’s First-Time Car Buyer Program

In 2011, Thailand implemented a tax rebate of up to $2,500 for first-time car purchases to boost domestic auto sales after devastating floods. The program succeeded in selling cars but saddled hundreds of thousands of households with debt they couldn’t afford.

Vehicle repossessions skyrocketed, domestic consumption collapsed, and many families entered financial ruin. What was intended as a stimulus measure essentially functioned as a massive subprime auto loan program with predictably disastrous results.

Like Go2Tutors’s content? Follow us on MSN.

Prohibition in America

The ban on alcohol production and sales from 1920 to 1933 was expected to reduce crime and corruption while improving health and hygiene. Instead, it created an enormous black market, empowered organized crime, and cost the government billions in lost tax revenue.

Prohibition effectively criminalized a significant portion of the population overnight while transferring an entire industry from legitimate businesses to criminal enterprises. The policy’s failure was so complete that it remains the only constitutional amendment to be entirely repealed.

The USSR’s Collectivization of Agriculture

Stalin’s forced collectivization of farms between 1928 and 1940 aimed to increase agricultural production and fund rapid industrialization. The policy led to widespread resistance from peasants, who slaughtered livestock and destroyed crops rather than surrender them.

Combined with Soviet industrial prioritization, this led to catastrophic famines, particularly in Ukraine where millions died in the Holodomor. A policy intended to modernize Soviet agriculture instead decimated production for decades.

Argentina’s Convertibility Plan

In 1991, Argentina pegged its peso one-to-one with the U.S. dollar to combat hyperinflation. While initially successful, the rigid exchange rate prevented necessary economic adjustments when circumstances changed.

When Brazil devalued its currency in 1999, Argentina couldn’t remain competitive but refused to abandon the peg. The resulting economic contraction culminated in a disastrous 2001 financial crisis – complete with bank runs, debt default, and political chaos that saw five presidents in two weeks.

Like Go2Tutors’s content? Follow us on MSN.

Ancient Rome’s Currency Debasement

Roman emperors from Nero onward progressively reduced the silver content in their currency to fund government expenditures. This short-term financial fix triggered centuries of inflation, eventually rendering Roman currency nearly worthless by the 3rd century CE.

The debasement undermined confidence in Roman institutions and contributed to economic instability that weakened the empire. This early lesson in monetary policy demonstrates that currency manipulation for short-term gain often leads to long-term economic disaster.

British Taxation in Colonial America

The series of taxes imposed on American colonies after the French and Indian War were designed to help pay Britain’s war debts. These relatively small taxes, implemented without colonial representation, triggered boycotts, protests, and eventually revolution.

The British government’s failure to understand the political impact of economic policies quite literally cost them their most valuable colonial possession… What seemed like reasonable revenue measures to Parliament transformed thirteen colonies into a revolutionary force.

Brazil’s Plano Collor

In 1990, President Fernando Collor de Mello froze all bank accounts over $1,000 for 18 months to combat hyperinflation. This effectively confiscated 80% of the country’s financial assets overnight.

Rather than stabilizing the economy, the shock caused a devastating recession, widespread business failures, and ultimately failed to tame inflation. The plan’s architect, President Collor, was later impeached for corruption, while everyday Brazilians suffered from one of history’s most extreme examples of government financial intervention.

Like Go2Tutors’s content? Follow us on MSN.

The Federal Reserve’s Contractionary Policy of 1937

After signs of recovery from the Great Depression, the Federal Reserve doubled reserve requirements for banks between 1936 and 1937, while the Treasury sterilized gold inflows. This premature tightening of monetary policy plunged the economy back into a severe recession, with manufacturing falling by 37% and unemployment rising back to 20%.

The “recession within the depression” extended economic suffering by years and demonstrated the dangers of withdrawing economic support too quickly during fragile recoveries.

Zimbabwe’s Land Reform Program

Beginning in 2000, President Robert Mugabe’s government seized white-owned commercial farms for redistribution. While addressing historical injustices was the stated goal, the implementation devastated agricultural productivity, as farms were often given to politically connected individuals without farming experience.

Agricultural output collapsed by 50%, exports evaporated, and food shortages became common. The policy triggered hyperinflation that reached crazy amounts – effectively destroying the country’s currency and economic foundation.

Spain’s Housing Bubble Policies

In the early 2000s, Spain implemented policies encouraging housing construction and ownership, including generous tax breaks and lax lending standards. Construction grew to account for 16% of GDP and 12% of employment by 2007.

When the bubble burst during the global financial crisis, housing prices collapsed by over 30%, unemployment soared above 26%, and the banking sector required massive bailouts. A decade of economic growth built on unsustainable policies unraveled spectacularly, leaving Spain with ghost towns of unoccupied developments.

Like Go2Tutors’s content? Follow us on MSN.

The Gold Standard During the Great Depression

Countries that remained on the gold standard during the early years of the Great Depression were forced to maintain high interest rates and contractionary policies when expansion was desperately needed. Nations that abandoned gold earlier recovered faster, while those clinging to the standard, like the United States until 1933, prolonged their economic suffering unnecessarily.

This rigid adherence to an outdated monetary system based on ideological commitment rather than pragmatic assessment deepened and lengthened the global depression.

Venezuela’s Price Controls

Hugo Chávez implemented strict price controls on basic goods in 2003, hoping to make essentials affordable for poor citizens. The policy made production unprofitable, leading to chronic shortages of everything from toilet paper to medicine.

As the economy deteriorated, the government printed money to cover deficits, triggering hyperinflation exceeding 1,000,000% by 2018. A policy intended to help people experiencing poverty instead created one of the worst economic collapses in modern history, transforming Latin America’s once-richest country into a humanitarian crisis.

South Korea’s Chaebols Policy

While initially driving rapid industrialization, the government’s favorable treatment of family-controlled conglomerates (chaebols) created enormous economic concentration. By the 1990s, the top five chaebols controlled 60% of the economy, stifling competition and innovation.

This concentration contributed significantly to the 1997 Asian Financial Crisis, when chaebol bankruptcies threatened the entire Korean economy. The economic model that had powered South Korea’s miracle growth ultimately required expensive bailouts and painful restructuring to prevent complete financial collapse.

Like Go2Tutors’s content? Follow us on MSN.

The Soviet Union’s Ruble Exchange Rates

The USSR maintained artificial exchange rates that significantly overvalued the ruble, supposedly demonstrating the currency’s strength compared to capitalist economies. This policy destroyed any possibility of meaningful economic integration with the global economy and created massive distortions in the Soviet economic system.

When Gorbachev’s reforms finally attempted market liberalization, the true weakness of the ruble and the Soviet economy was exposed, accelerating the system’s collapse. Decades of economic fiction ultimately confronted economic reality with predictably catastrophic results.

U.S. Mortgage Interest Deduction

This tax policy, intended to promote homeownership, has instead primarily benefited wealthier households while contributing to housing bubbles. By artificially increasing housing demand without addressing supply constraints, the policy has helped drive housing unaffordability in major cities.

What began as a temporary provision in 1913 evolved into a politically untouchable subsidy that distorts capital allocation, inflates housing prices, and primarily benefits those who need assistance least – a classic example of how well-intentioned policies can produce effects directly contrary to their stated goals.

When Good Intentions Meet Complex Systems

These failed policies share a common thread – they attempted to impose simplistic solutions on complex economic systems without accounting for how people and markets would adapt. From ancient Rome to modern Venezuela, policymakers have repeatedly discovered that economic forces often respond to intervention in unexpected ways, frequently producing results opposite to those intended.

The human costs of these miscalculations have been staggering, measured not just in financial losses but in lives disrupted and sometimes lost.

Perhaps the most important lesson is one of humility. Economic systems involve billions of individual decisions, cultural factors, and institutional dynamics that no model can perfectly capture. As new economic challenges emerge, from climate change to automation to inequality, these historical failures remind us that well-intentioned policies without careful consideration of incentives, adaptations, and complex system dynamics can lead to consequences far more disastrous than the problems they were designed to solve.

More from Go2Tutors!

- 20 Historical Artifacts That Scientists Can’t Explain

- 20 Little-Known Historical Battles That Had Huge Consequences

- 20 Countries That No Longer Exist and What Happened to Them

- 20 Forgotten Fast Food Items From the 80’s That Need to Come Back

- 20 Weapons from the Past That Were Deemed Too Barbaric for War

Like Go2Tutors’s content? Follow us on MSN.