The 10 Worst Stock Market Crashes in History, Ranked by Financial Loss

The stock market’s volatile nature has led to several catastrophic events that have reshaped global economics and changed how we approach financial markets. These crashes serve as stark reminders of market vulnerability and the interconnected nature of global finance.

Here’s a list of the 10 most devastating stock market crashes, measured by their total financial impact in inflation-adjusted dollars.

2008 Financial Crisis

The housing bubble’s collapse triggered a chain reaction that erased $8 trillion in value. Major institutions like Lehman Brothers vanished overnight, while millions lost their homes and retirement savings.

The Federal Reserve’s unprecedented intervention included purchasing toxic assets and dropping interest rates to near zero. Banks created complex mortgage-backed securities that few understood, leading to a complete freeze in lending markets.

The aftermath led to the Dodd-Frank Act, fundamentally changing financial regulation in America.

The Dot-com Bubble

Technology stocks plummeted in 2000, wiping out $5 trillion in market value. Companies with no profit burned through millions in venture capital based purely on website traffic.

Amazon’s stock fell from $107 to just $7 per share. Tech startups gave away outlandish perks like in-office massage chairs and daily catered lunches.

The crash taught investors that traditional business metrics still matter in the digital age.

Like Go2Tutors’s content? Follow us on MSN.

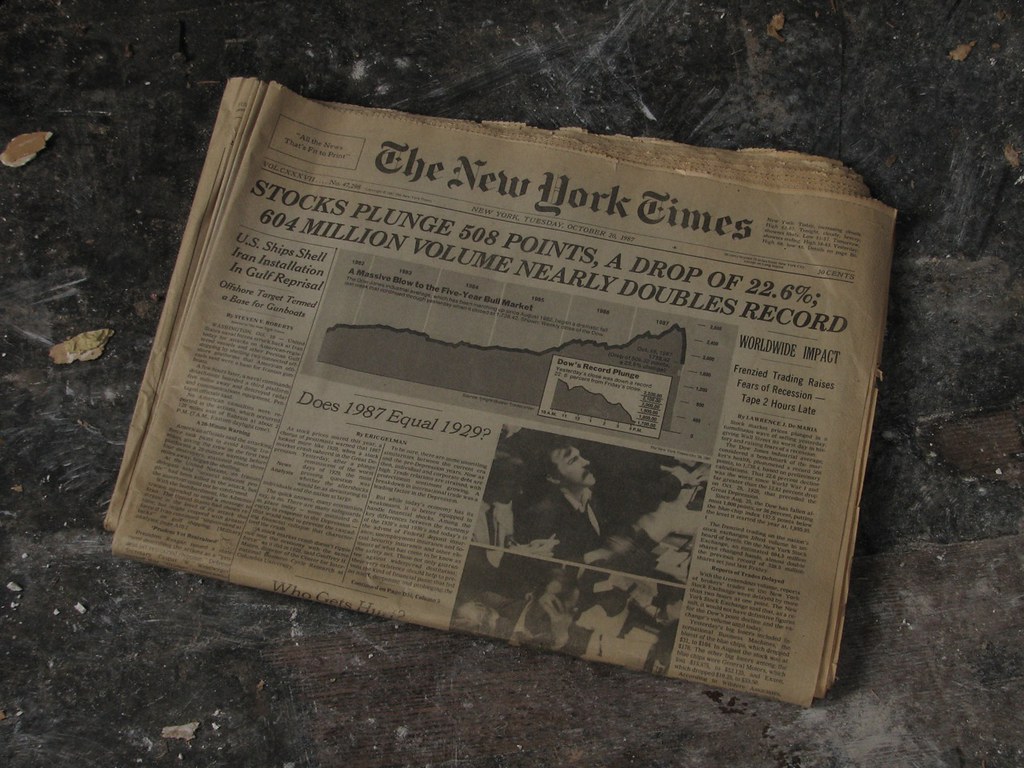

Black Monday 1987

The market lost $1.7 trillion in a single day as computerized trading programs triggered massive sell orders. The Dow dropped 22.6%, still the largest one-day percentage decline in history.

Trading screens showed nothing but sell orders, creating an eerie silence on trading floors. Program trading was immediately restricted, and circuit breakers were introduced.

The event exposed the dangers of automated trading systems lacking proper safeguards.

1929 Wall Street Crash

This $1.3 trillion crash launched the Great Depression. Banks had allowed speculation with just 10% down payment on stocks.

Wealthy investors lost fortunes while average Americans lost their life savings. The crash led to the creation of the SEC and fundamental market reforms.

This event permanently changed America’s relationship with investing and banking.

Japanese Asset Bubble

Japan’s 1989 crash erased $1.2 trillion as real estate and stock prices collapsed simultaneously. Tokyo’s Imperial Palace grounds were theoretically worth more than all of California.

Companies bought famous art pieces and golf courses at astronomical prices. The crash led to Japan’s ‘Lost Decade’ of economic stagnation.

Some real estate prices still haven’t recovered to their 1989 levels.

Like Go2Tutors’s content? Follow us on MSN.

Black Thursday 1929

The prelude to the 1929 crash wiped out $1 trillion as panic selling gripped Wall Street. Traders formed crowds outside the New York Stock Exchange, desperately trying to sell.

Some bankers attempted to stop the crash by publicly buying large blocks of stocks. Thousands of banks failed in the following months.

This day marked the beginning of America’s worst economic disaster.

1987 Global Crash

International markets lost $900 billion as Black Monday rippled worldwide. Hong Kong’s market closed for a week to prevent further panic.

London traders nicknamed it ‘Black Fortnight’ as their losses extended for two weeks. The crash showed how interconnected global markets had become.

This event led to the first international coordination among central banks.

1974 Oil Crisis Crash

OPEC’s oil embargo triggered an $800 billion market collapse. Gas stations posted ‘Sorry, No Gas’ signs across America.

The S&P 500 lost 48% of its value in less than two years. The crisis permanently changed American car buying habits.

This crash demonstrated how dependent markets had become on oil prices.

Like Go2Tutors’s content? Follow us on MSN.

1937 Recession

This $750 billion crash came just as the economy was recovering from the Great Depression. The Fed’s premature tightening of monetary policy sparked the collapse.

Industrial production fell by 32% in eight months. This crash showed how delicate economic recoveries can be.

The event changed how central banks approach policy during recoveries.

1957 Cold War Crash

The launch of Sputnik sparked a $700 billion selloff as Cold War fears intensified. Defense stocks initially soared before the broader market collapsed.

The crash coincided with a significant flu pandemic. This event highlighted how geopolitical events can trigger market panics.

The recovery led to increased government spending on technology and education.

Markets and Memory

These crashes remind us that markets operate on a complex mix of mathematics and human psychology. While trading technology has evolved, market behavior remains remarkably consistent.

Today’s safeguards exist because of lessons learned from these disasters, though as history shows, financial innovation often creates new forms of risk.

Understanding these past crashes helps investors navigate future market turbulence with greater wisdom.

More from Go2Tutors!

- 20 Historical Artifacts That Scientists Can’t Explain

- 15 Unforgettable Candy Bars From The 60s and 70’s That Disappeared Too Soon

- 20 Countries That No Longer Exist and What Happened to Them

- 20 Forgotten Fast Food Items From the 80’s That Need to Come Back

- Famous Battles: How Much Do You Really Know About U.S. History?

Like Go2Tutors’s content? Follow us on MSN.