Feds Announce How Much Student Loan Forgiveness Will Cost

The Congressional Budget Office says that student loan forgiveness will cost the nation $420 billion over the next three decades.

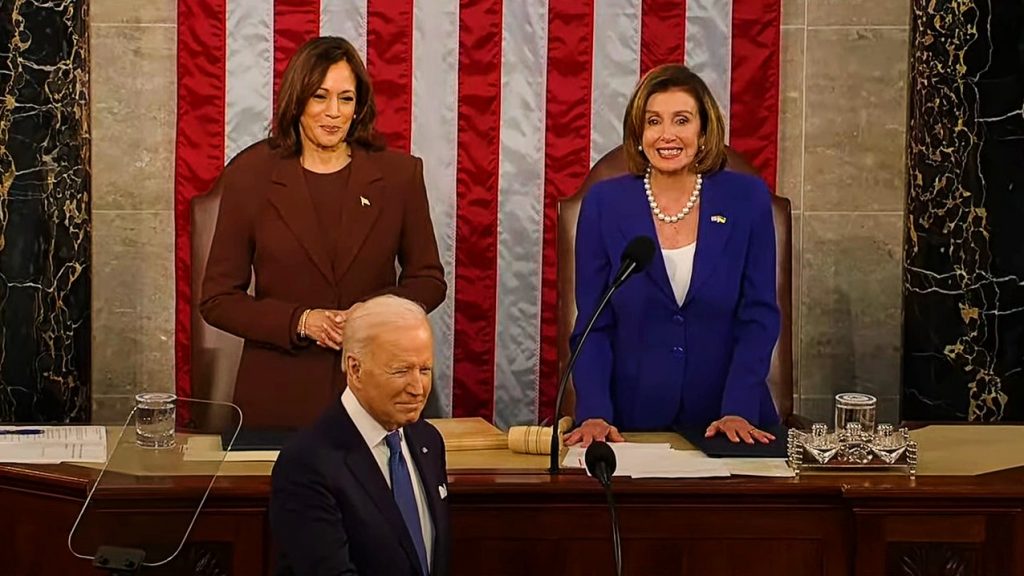

Since President Biden announced his executive order canceling student loan debt for millions of Americans, people have wondered how much this unprecedented measure would cost the nation. Some estimates suggested that student loan forgiveness could cost up to $1 trillion altogether. But now, the feds have released their official proposal, estimating that the maneuver will total $420 billion.

This figure was released Monday morning by the Congressional Budget Office (CBO), a nonpartisan federal agency. Republican lawmakers had urged the agency to release figures estimating how much the hefty student loan forgiveness act would cost the federal government for quite some time. The official request came from Republican Sen. Richard Burr, the ranking member of the Senate Committee on Health, Education, Labor and Pensions.

The CBO reiterated that the $420 billion student loan forgiveness figure was an estimate, and not final. Altogether, they appraised Biden’s plan as costing $400 billion over the next 30 years. The other $20 billion comes from his extension of the student loan payment moratorium that allows borrowers to make no payments on their loans through the end of the year.

This new projection appears to differ from the White House’s estimates reported last month. According to USA Today, the Biden Administration suggested that student loan forgiveness would cost the United States $24 billion per year for just a decade, far underrepresenting the CBO’s estimate. The means to come to both groups’ estimates varied as well.

The White House came to their total cost estimated with the belief that just 75% of qualifying borrowers would apply for student loan forgiveness. However, the CBO’s figures were based on the assumption that 90% would take advantage of the offer. Adamant that their figures are more accurate, Biden’s administration said that they came to that percentage based on participation in past similar federal programs.

One official from Biden’s administration, who spoke with reporters anonymously, said the CBO’s forecast seemed on par with the estimate from the White House. However, they noted that the belief that 90% of all borrowers will apply seemed far-reaching. Many borrowers have to apply in order to receive any reimbursement, and some have to go further, first requesting rebates from their loan providers.

Maya MacGuineas, the president of the Committee for a Responsible Federal Budget slammed Biden, as the extensive cost estimates continue to worry many Americans. “This might be the most costly executive action in history,’ she said. Other Republicans reiterate her sentiments, and every Republican Governor sent the president a letter recently urging him to cancel his student loan forgiveness plan.

Furthermore, opposers officially brought a lawsuit against Biden in a federal court yesterday. Initiated by The Pacific Legal Foundation, the law firm looks to block student loan forgiveness before it can be enacted. The suit alleges that the act will unfairly punish certain borrowers, along with arguing that it was part of abuse of executive power.

The nation continues to fight over the student loan forgiveness act, its legality, and possible budget constraints on America. Adversaries are attempting to get the measure blocked, with fears that $420 billion or possibly more will be wasted money that does nothing to solve the nation’s issues with costly higher education. If the court system agrees, however, these cost estimates may end up futile.