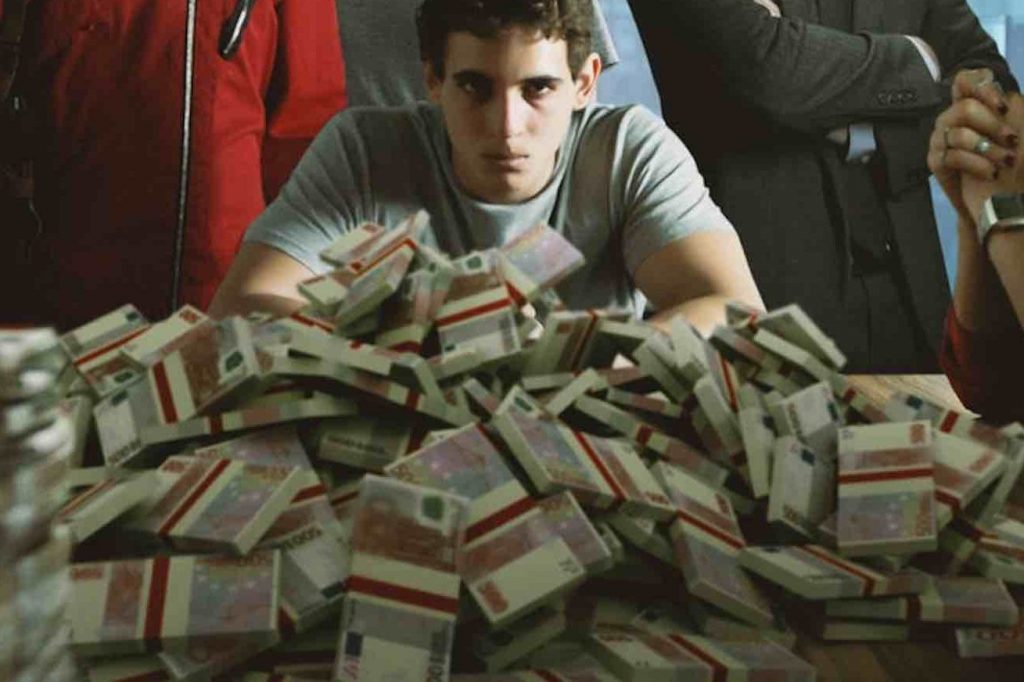

100,000 Student Loans To Be Paid Off By American Tax Dollars

As Biden ramps up student loan forgiveness initiatives many argue over the hefty price tag associated with the tax dollars to fund it.

As student loan price tags continuously skyrocket, the Biden administration continues its momentum in pushing more loan forgiveness. Student loan debt is now the second-highest consumer debt category in the United States. And as more and more college students remain unable to keep up with the crippling debt from attaining college degrees, the great debate between political parties argues over how loan forgiveness programs will be funded. Last Wednesday, the Biden administration announced that 100 thousand student loan borrowers now qualify for $6.2 billion in student loan forgiveness under a newly expanded program for borrowers that work in public service careers.

Under the Public Service Loan Forgiveness (PSLF) program, more borrowers than ever will qualify for student loan forgiveness. The program was first initiated in 2007 under the College Cost Reduction and Access Act. The program’s goal was to provide loan indebted workers a way out of their federal student loan debt burden if they worked full-time in public service and had made qualifying payments for ten years. A slow work in progress, likely due to funding issues, the PLSF program reported that a dismal 2,215 borrowers had their student loans forgiven under the program as of 2020. As it seemed more student borrowers should have been covered under the program, the rules regarding what constituted qualifying payments resulted in an upsetting minuscule approval rate.

To combat the frustration felt from loan borrowers who thought they should qualify for forgiveness but ultimately were turned down, the Biden administration first announced the new initiative set to increase qualified borrowers within the PSLF program this past October. Named the Limited PSLF Waiver, the initiative made it possible for the Education Department to temporarily count past periods of repayment that would have, or already had been rejected under PSLF’s original rules. This included student loan payments made on non-Direct federal loans like FFEL-program loans and payments that were made under non-qualifying repayment plans.

Much like the original program, the rollout of the Limited PLSF Waiver program has had its fair share of mishaps. So far, some loan borrowers have reported that they have received more misinformation from loan servicers regarding the requirements of the waiver. Similarly, some report significant, if not purposeful hold times as borrowers attempt to contact their loan servicers for more information on the forgiveness program. To combat this, a federal watchdog agency enacted a warning to student loan companies, stating there will be harsh consequences for loan servicers found guilty of any illegal conduct related to the waiver program.

As nearly 100 thousand new borrowers once again become eligible for student loan forgiveness, many still argue over the initiative. Opponents of canceling the debt argue that the forgiveness program is too broad. While many Americans struggle to keep up with student loan payments, the problem isn’t homogenous. Furthermore, it differentiates from economic stimulus’ that tend to grow the economy with a large cash windfall. And lastly, many argue that the billions of funds needed from the federal government could be spent elsewhere.

No matter which side of the forgiveness program you stand on, it’s hard to deny that the initiative fails to address the underlying issue regarding student loan debt. College tuition continues to rise at an alarming rate, and future borrowers look to be faced with the same issues. Where will their future forgiveness funds come from? Even if the Biden Administration wipes 100 thousand borrowers’ student loan balances today, the next decade will bring another 100 thousand, if not more.